Islamic Mortgages and Why They’re Not Just for Muslims

Islamic Mortgages and not just for Muslims which may come as a suprise for some. However, an Islamic mortgage does have its differences.

What is an Islamic Mortgage?

According to Islam, making money from money is “usury” and is not permitted. This includes receiving or paying interest (it is wrong to assist another in making money from money).  This creates an obvious problem for a muslim who wishes to own his own property. Buying outright with cash will not be an option open to the vast majority and a traditional interest based mortgage loan cannot be obtained with compromising his religious beliefs. Islamic mortgages (also called Shariah or Halal mortgages) were introduced to combat this problem and provide a method of obtaining finance from a lending institution without paying interest. Whilst the the main purpose of this method of borrowing is to allow muslims to maintain their beliefs while leading normal lives when living in non-Islamic countries, it has other advantages which have nothing to do with religion.

This creates an obvious problem for a muslim who wishes to own his own property. Buying outright with cash will not be an option open to the vast majority and a traditional interest based mortgage loan cannot be obtained with compromising his religious beliefs. Islamic mortgages (also called Shariah or Halal mortgages) were introduced to combat this problem and provide a method of obtaining finance from a lending institution without paying interest. Whilst the the main purpose of this method of borrowing is to allow muslims to maintain their beliefs while leading normal lives when living in non-Islamic countries, it has other advantages which have nothing to do with religion.

How Do Banks Make a Profit?

Naturally banks still want to make a profit on the money they lend and they do this by either buying the property from the seller at the normal agreed price and selling it on the borrower for a higher price or by buying the property and renting it to the borrower during the continuance of the term.

How Do Islamic Mortgages Work?

There are two main types of Islamic Mortgage, Murabaha and Ijara:

Murabaha

With this arrangement the purchaser finds a property and agrees a purchase price with the seller in the usual way.The bank then purchases the property on behalf of the buyer and immediately sells it to the buyer at a higher price. A percentage of the purchase price (the deposit) is paid to the bank immediately and the remainder is paid in monthly instalments over the term. The instalments are fixed over the life of the term. The maximum amount of the purchase price the bank will agree to defer will be 80%, in other words a minimum 20% deposit will be required to obtain this type of mortgage so it is only suitable for those buyer who have substantial capital to invest.

Ijara

Again, you will find a property and agree a purchase price and the bank will buy the property, however with this arrangement the property will be registered to the bank who will grant a lease to you and give you a “promise to sell”.

The term of the lease will be equal to the term of the mortgage. You will make monthly payments which compromise a rent for the use of the bank’s share of the property and a payment to acquire part of the bank’s share. The rent payments will usually be reviewed each year, just as rent on an assured shorthold tenancy might be. At the end of the term you will have acquired all of the bank’s share and the bank will be required to make good on its promise to sell by transferring the freehold title to you. The lease term will have come to an end and it will be extinguished. The advantage of this arrangement over Murabaha is that a smaller deposit will be acceptable, perhaps 10%.

What if I Have an Islamic Mortgage and Want to Sell Before the End of the Term?

There is no reason that you cannot sell before the end of the term and repay the borrowing in full, and this can usually be done without penalty. The bank’s promise to sell is simply enforced earlier. You would only pay the bank the amount originally borrowed less any payments already made, so that the bank does not get a share of any increase in value.

Which Banks Provide Islamic Mortgages?

There are a number of banks which provide Islamic mortgage products, including Bristol & West, HSBC and the Islamic Bank of Britain among others.

Can I Get Repossessed if I Have an Islamic Mortgage?

Unfortunately yes, you always at risk of repossession if you purchase a property with the benefit of a mortgage and fail to keep up repayments.

I’ve Heard I Might Have to Pay Two Lots of Stamp Duty?

It used to be the case that with a Islamic mortgage, you had to pay stamp duty once on the original purchase and again at the end of the mortgage term when the bank transferred the property to you, but this was remedied in the Finance Act 2003 and is no longer the case.

I’m Not a Muslim, So Why Would I Get an Islamic Mortgage?

One advantage of the Murabaha type of mortgage is that the payments are fixed throughout the life of the term. This means you don’t have to worry about your payments increasing to a level you can’t afford if there is a sharp rise in interest rates, as would happen with a conventional mortgage. Obviously the disadvantage is that you would not benefit from any decrease in interest rates.

The monthly payments on this type of mortgage will be calculated based on the interest rate prevailing at the time so while rates are low, although initially the payments will be higher than a traditional mortgage (the bank will set the payments higher because they know they cannot be changed), over the life of the mortgage as interest rates but your payments don’t, you may well end up better off.

With the Ijara type, payments are reviewed annually and will increase and decrease in line with interest rates.

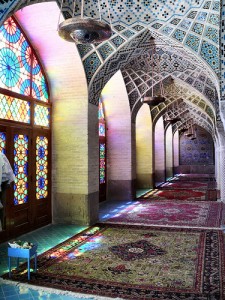

Photo by dynamosquito

You can follow any responses to this entry through the RSS 2.0 feed. Both comments and pings are currently closed.